Why Women Should be Financially Literate

Financial awareness is a topic that has been gaining relevance over the past few years, given the growing importance of building and maintaining a reasonable net-worth to get through the later stages of life.

For women it is quite typical that financial decisions are left to the men in the family (fathers, husbands, brothers), even for their own money. With Women’s salaries rising, women marrying late and more women choosing to remain single, it is extremely critical that in today’s time you empower yourself to manage your own monies, or understand how monies are managed and ask the right questions.

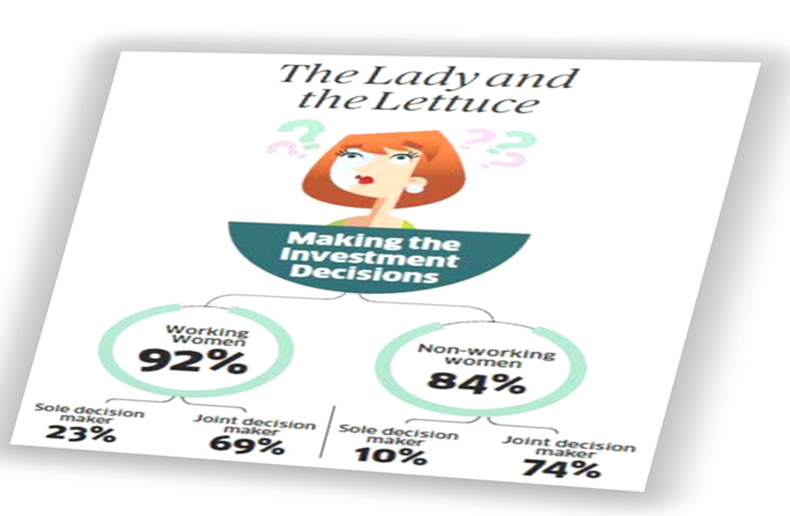

A study done by DSP Blackrock Mutual Fund revealed some interesting figures

1) 77% of working women depend on spouse and/ or parents for their investment

2) Only 23% of them claim to be sole decision makers, when it comes to their own investments.

3) Only 18% and 13% of single working women and married working women respectively take their own investment decisions.

This only goes to show that while women have control of day to day financial matters equal to that of men however it does not spread to the over all picture of wealth accumulation, understanding investments, financial planning and dealing with financial advisers.

Empower yourself with investment knowledge. It gives the best interest and the best investment is an investment in yourself!

So are you a lady who multi-tasks at home and office but depends on a male family member to handle all the financial affairs? Or do you control your monies? Perhaps you fall somewhere in the middle. Assess your financial understanding by answering a few questions-

1. Do you know household budget?

2. Do you have emergency savings and If so, how much?

3. Are you aware of your savings and who selects and manages your investments?

4. What are your financial goals and have you planned for them?

5. How have you planned to pass on your financial legacy?

Regardless of whether you could answer all the questions correctly, the most important lesson is to pay attention to your finances so you are knowledgeable and prepared.

It’s no rocket science and you do not need to be mathematician to understand how to manage your monies.

Womantra helps you empower your self to manage your monies

5 womantras to empower yourself and manage and understand your wealth.

Womantra 1 –KNOWLEDGE -An investment in knowledge gives the best interest (Benjamin Franklin).

Educate oneself on the basics of money management. One must have basic knowledge of concepts like inflation, compounding, risk which effect one’s investments. There are many simple products available like PPF, post office schemes, Mutual Funds, Insurance Products including medical Insurance. Once must learn the basics of these products and most importantly understand the risk associated with each of these investment avenues.

The internet is an ocean of information on any of the above subjects.Indiapost has information on PPF and post office schemes. The Indian mutual fund websites have very good articles for investor education amfiindia.com. There are various websites which compare insurance policies. These can be used to check on various insurance policies. Apart from that a few financial education programs are also conducted which help you understand the above from a practical aspect.

Womantra 2 Be AWARE of Goals and needs - Don’t save after you spend, Save and then spend (Warren Buffet).

Start saving yourself, from your salary if you are working or from your home budget if you are a home maker. Be it investing in mutual funds or a ppf a/c. Know where your money is being put and how it will grow.

Set a goal for which you wish to save. Goals could be long term for e.g. children’s education or short term to gift your parents a holiday. Goals could also be as simple as trying to invest on a regular basis to build a nest egg which could be used for other lifestyle needs like foreign vacation etc.

The product you invest in should match you goal. Example PPF is one of the investments which can be used for retirement planning and Mutual Fund SIPs can be used to plan for children’s education.

Womantra 3 Financial Planning- If you don’t have a plan you will be part of someone else’s plan.

Once you have acquired some knowledge and have an idea on the goals you wish to save for, you action your financial journey by creating a financial plan. Don’t wait until a money crisis to begin financial planning. The earlier you start the better off you would be in the long term. If you are investing for the first time on your own start small understand and then invest. Learn where others have invested for you (what kind of products your husband/father has invested in.)

You can use freely available tools and calculators on MF websites to get an idea on how financial planning works.

Womantra 4: Do not procrastinate – do it yourself

Having gone through a financial plan, to put into action your learning on basic concepts and products, it is important that you try and evaluate your portfolio independently. Try to evaluate how well your investments are helping you reach your goals. For this you can see how much of your goal has been reached at the end of the year by each of the investments in your portfolio.

Womantra 5: Finally it is very important to have your financial documents in order and you must create an inventory of all your financial assets.

Investment isn’t a skill but a habit!

Mrin Agarwal & Rima H

Founders and Trainers Womantra